#BudgetSpeech, #Downgrade, #Deficit, #Dollar/Rand, #Barclays are all trending topics at the moment and they will affect you as a citizen or resident of South Africa directly. In this post, I will attempt to unpack these topics in the simplest terms so you as the reader will understand how these moving parts affect your pocket.

Budget Speech

Last week, I had the privilege of being a panelist of the ABSIP (Association of Black Securities and Investment Professionals) Budget Speech Powertalk. My view of the speech was that while the Minister presented a number of plans to reduce the budget deficit over the next three years not enough detail was provided on how this will be achieved by way of policy reform. I was however encouraged by the Minister’s emphasis on the importance of collaboration between business and government which is tantamount to stimulating growth in our stagnant economy. But perhaps the biggest shocker of the budget speech was the lack of income tax hikes. Analysts were adamant in the weeks leading up to the speech that an increase in personal income tax, VAT or company tax was more than likely. Neither of these tax metrics were adjusted and the intention was to stimulate much needed growth.

The increase in personal income tax is quite simple to understand, if you were paying 41% tax last year and 42% tax this year then you are contributing more to government coffers. However, don’t be fooled, Treasury will still be earning more tax from you, despite no official increase in income tax this year, by way of what is termed the “fiscal drag”. Tax brackets for middle to high income earners have not been significantly adjusted for inflation, this means that if you receive an annual salary increase you may be forced into a higher tax bracket and therefore pay more tax. Without the inflation adjustment in real terms you may not be earning more than you did before your increase. This is likely to affect those earning approximately R400 000 per annum or more. Those earning less will receive some relief from the inflationary adjustments and the increase in the minimum tax threshold to R75 000 per annum.

I am not a proponent in the increase of a regressive tax such as VAT. A progressive tax system ensures that the more you earn the more tax you pay. Increasing VAT will hurt low income earners across the board and not only reduce aggregate demand but threaten public’s trust of the government. An increase in company tax is an absolute “no-go” zone, the ramifications of this would be widespread across income groups and will likely trigger capital flight i.e. foreign companies withdrawing from South Africa. Instead, significant increases in capital gains tax and transfer tax (for properties above R10 million) were announced as well as the usual suspects- sin tax, fuel levy and now sugar tax. I’m quite amused by the sugar tax and wholly support the health benefits that underlie the intention of its implementation however I may need more convincing as to whether it will really change consumer behavior. I applaud the Minister for not touching the direct tax and rather focusing on indirect and wealth tax.

Downgrade and Deficit

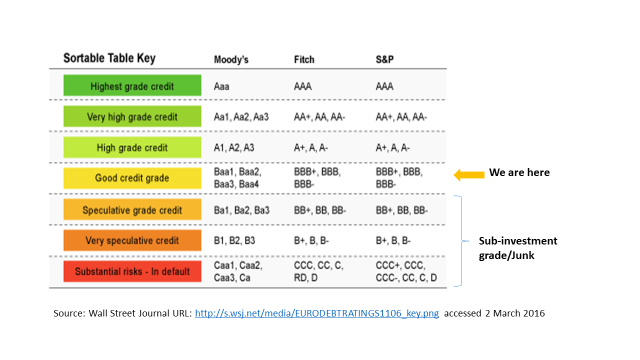

National Treasury have adjusted the economic growth forecasts to 0.9% this year and 1.7% in the next fiscal year. This is one of the key metrics that inform the credit rating decision undertaken by the top 3 credit agencies- Standard and Poors (S&P), Moody’s and Fitch. Credit agencies exist to inform investors on the creditworthiness of a company or country. What is meant by creditworthiness is the ability to meet debt repayment obligations. A simple example would be a typical clothing account or bond. The bank will charge you a rate based on its perception of your creditworthiness, the more favourable your profile the better the interest rate charged. This works more or less the same for sovereign debt i.e. a country’s debt obligations. Why we have sovereign debt in the first place is largely to fund the budget deficit which is the gap between what is earned by the government through tax and what the government spends. Below is an example of credit grading matrix used by the top 3:

The 2016/17 budget deficit is 3.2% and Minister Pravin Gordhan has announced that this will reduce to 2.4% in the 2018/19. News headlines in the weeks leading up to the budget speech were dominated by the possible downgrade of South Africa’s sovereign credit rating to sub-investment grade. The current credit rating is one notch away from being deemed junk (sub-investment grade), this means that there is at least a 1 in 3 chance of South Africa defaulting on its debt obligations. The worst case consequences of a ratings downgrade would be the calling up of South African bonds i.e. lenders demanding settlement of the outstanding balance. However, demanding settlement is an unlikely scenario. What will definitely happen if sovereign debt is downgraded to junk, is that bonds and loans will be repriced at higher interest rates further straining the country’s ability to meet its obligations and its ability to borrow. This causes a domino effect on the wider economy including, but not limited to, foreign capital flight and currency depreciation.

The Rand

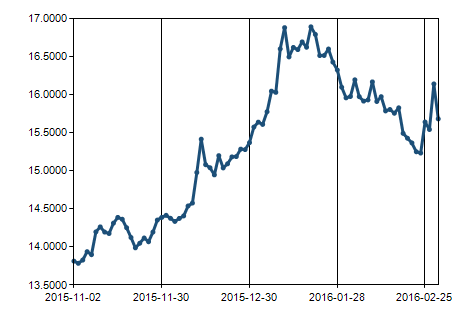

The dollar/rand exchange rate is on everyone’s lips and it’s the one economic indicator that everyone can and wants to relate to. The oscillation of the exchange rate inspires fear and hope in many but it may not always clear to the layman what drives movements and what the consequences are. The Rand traded at a record high of R17.99 to the Dollar when the previous Minister of Finance Nhlanhla Nene was fired in an unprecedented move. In the wake of the 2016 budget speech, the Rand depreciated against the dollar. These two incidents are reflective of investor confidence. Perceptions of political and economic growth drive investors to either buy or sell the Rand. Below is graph illustrating the Rand/Dollar exchange from 1/11/15 to 2/3/16:

Selling the Rand (for Dollars) creates excess supply in the market thus decreasing price for every 1 Dollar bought. Depreciation is not all doom and gloom, it helps the current account deficit by making our exports cheaper. The converse is, of course, imports become more expensive so an exceptionally strong currency for a developing economy or an exceptionally weak currency is not ideal. South Africa is a net importer of goods and services.

How a depreciating currency affects your pocket directly is rising prices for imported goods and services and increases in interest rates which affects any debt obligations you may have. Interest rates are likely to continue to rise to curb inflation. My advice is to reconsider any major asset acquisitions such as property and save more, you can find more savings and budgeting tips here.

Barclays

Barclays Plc announced on 1 March 2016 that it would be unwinding its 62.3% shareholding in Barclays Africa/Absa over the next 2 to 3 years. This is an example of foreign capital flight, although the main impetus of the divesture is due to the greater operation and profitability efficiencies at a group level it does have a negative impact on investor confidence. The market did take a slight hit but not as badly as one would expect.

Political instability, SARS wars, student protests, falling commodity prices, stagnant growth, rising electricity prices, rising interest rates all sound like the beginning of the end. But it isn’t. The best way to ride this wave is to implement a few austerity measures of your own, save as much as you can, review your investment portfolio and most of all remain positive about the future of South Africa.

Best

Nswana

Co-founder of Mbewu Movement

Sources:

https://www.resbank.co.za/Research/Rates/Pages/SelectedHistoricalExchangeAndInterestRates.aspx

http://www.treasury.gov.za/documents/national%20budget/2016/speech/speech.pdf